The other week I wrote about why I people should have more illiquid assets. With companies staying private longer a lot of the value creation, and therefore return on investment, is closed off to the average investor. I think that sucks, so in this post I’m going to give a brief overview of how to invest in startups before they’re even public companies.

Until recently this year I assumed you had to be very wealthy to invest in startups. I knew first hand, having raised some $550,000 from angel investors in the San Francisco bay area. While this is paltry by Silicon Valley standards, the process is relatively the same. And it’s the fundraising process that led me down to the path of making my first angel investments.

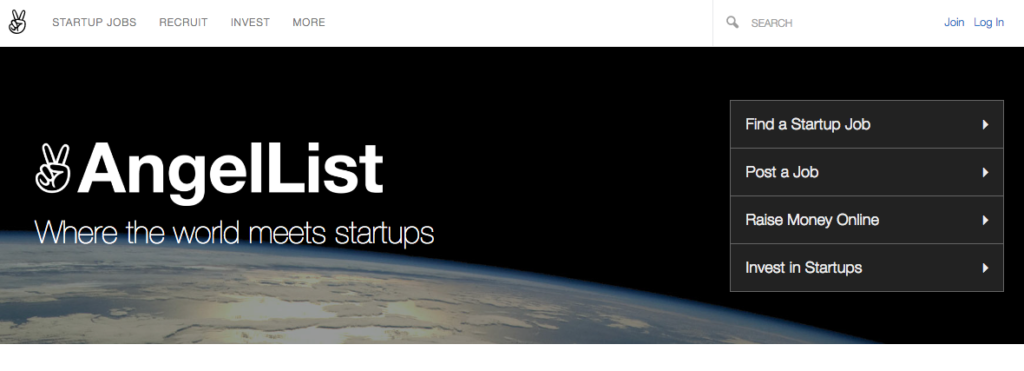

Beefing up our AngelList profile

In March 2016 I decided that my company was going to raise more venture capital. We didn’t have to do this, we were profitable. But we finally had a clear path to growth that was scaleable. Why not add fuel to the fire and move a bit faster? Well, there are lots of reasons you may not want to do that, but that topic is for another day.

I committed to exploring our fundraising options. And you have to be committed. It’s a ton of work to put together a pitch deck, work your network to get introductions to land meetings with investors, iterate, do it all over again, etc. etc.

In short, it’s a long, painful, draining process that takes up all of your time.

And one of the first steps in this process in the last few years has been making sure your AngelList profile is up to date and looking its finest. It’s kind of like making sure your LinkedIn profile is current when you’re looking for a new job. Prospective investors can find you through AngelList, but they’re far more likely to at least check you out there while doing light due diligence.

Easy enough, right?

Not entirely. While AngelList profiles are public, the important stuff that investors look at is only viewable to investors. So you can’t really look at the profile of a company that’s recently raised a round and see how they approached things.

How to invest in startups: are you accredited? Sure!

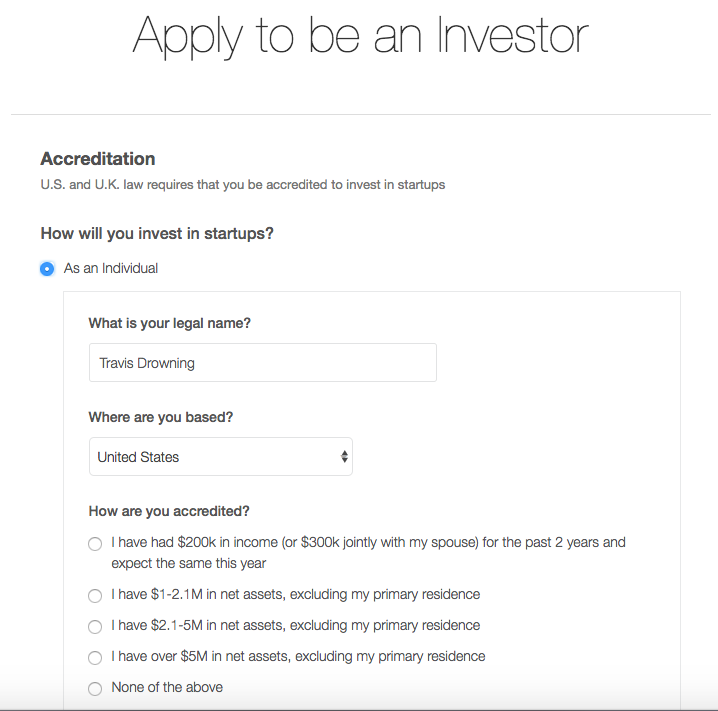

At the time, I wasn’t an accredited investor. But I wasn’t going to let that deter me from at least trying to get on the other side of those AngelList profiles. So I decided to apply as an investor too. Here’s the key screen I was shown during my investor application process:

Again, when answering “How are you accredited” I’d be forced to answer “None of the above”. But how silly is this? I’ve been investing in the stock market since I was about ten years old. My dad helped me start a ROTH IRA when I was 14. I’d worked at a hedge fund, as a financial analyst, and a as management consultant.

In short, I had a ton of experience with finance and investing. Sure, I wasn’t wealthy, but that didn’t mean I was ignorant. Being an entrepreneur that had raised venture capital, I also understood the risks of investing in early stage companies.

But this post isn’t about becoming an accredited investor or the silly criteria to be considered accredited. I’ll leave you to this awesome post if you’re interested in the topic.

My point is, when I clicked an option that was not “None of the above” I did not feel a twinge of guilt. And after a couple more clicks… boom, I was in! I now also had an investor account on AngelList with access to the details in company profiles I couldn’t view before.

My first angel investment

Although I went through the process of updating our AngelList profile, creating and iterating on a pitch deck, and meeting with investors, we didn’t end up raising another round of capital for a lot of reasons.

But what I did end up doing was making my first angel investment!

In April, 2016 I invested $5,000 in a company called Radiator Labs. The company makes a product that converts old, steam radiators into more efficient heaters. I lived in Chicago for almost two years in an apartment with steam heaters, so I identified with the problem immediately.

Once you start…

Since making my first angel investment in April, 2016 I’ve made seven more. As far as angel investors go, I’m an extremely small fish. Of my total eight investments I’ve only put $18,500 to work between them all. But for me, that’s significant.

Next week I’m going to show you how to invest in startups via AngelList and give you a sneak peek at what an investors account looks like. They’ve got a pretty slick system that is truly democratizing the angel investing landscape.

In the meantime I’d love to know if you’ve ever made any angel investments through AngelList, offline, or some other channel. What has your experience been?

If you haven’t made angel investments before, why not? Do you think you’d consider it?